Get the free purchase contract example

Show details

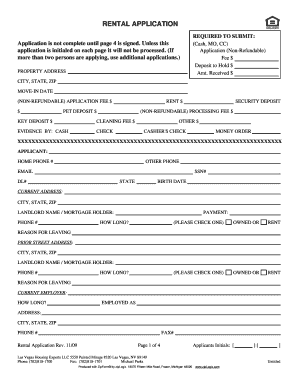

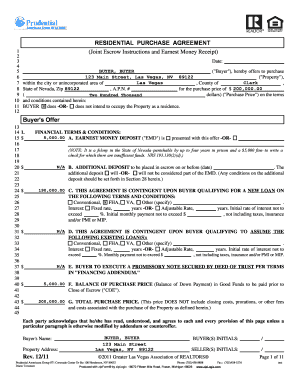

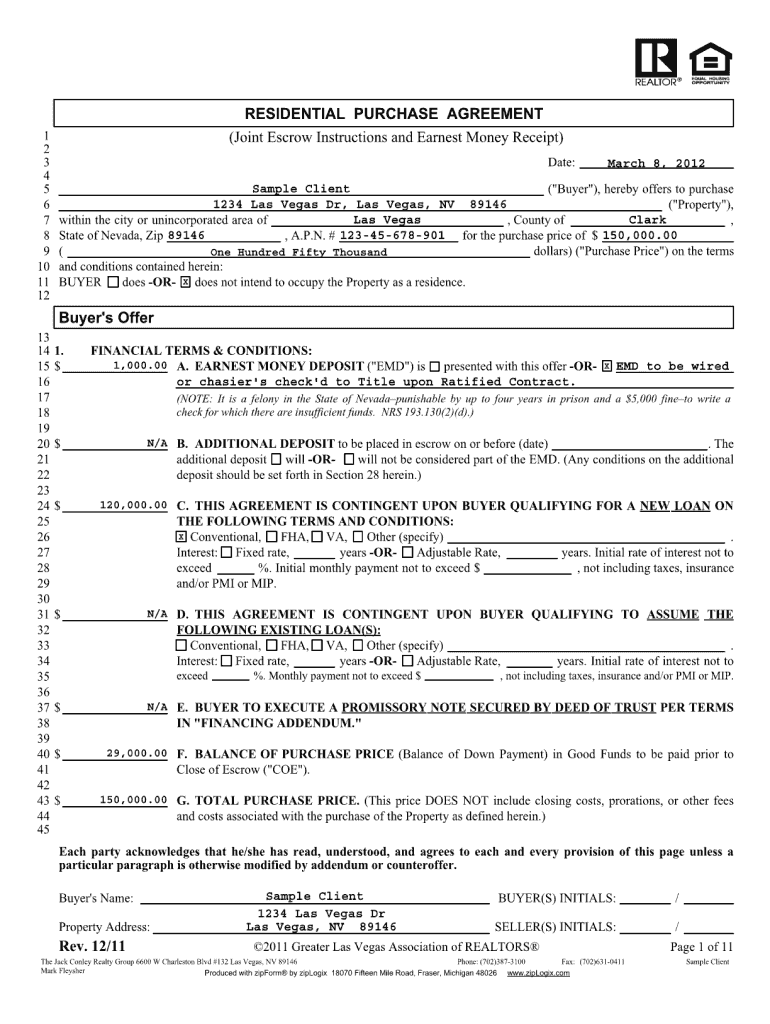

1 2 3 4 5 6 7 8 9 10 11 12 RESIDENTIAL PURCHASE AGREEMENT (Joint Escrow Instructions and Earnest Money Receipt) Date: March 8, 2012, Sample Client (Buyer”), hereby offers to purchase 1234 Las Vegas

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign glvar login form

Edit your how to fill out a purchase agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your purchase agreement example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sample purchase agreement online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit simple earnest money agreement form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out glvar application form

How to fill out earnest money agreement sample:

01

Start by reviewing the agreement: Carefully read through the entire earnest money agreement sample to familiarize yourself with its terms and conditions.

02

Gather necessary information: Before filling out the agreement, collect all the required information, such as the buyer's and seller's names, contact details, property details, purchase price, and the amount of earnest money to be deposited.

03

Date and sign the agreement: Begin by entering the date on which the agreement is being executed. Both the buyer and seller should then sign the agreement to indicate their acceptance of its terms.

04

Provide buyer's information: Complete the section that requests details about the buyer, including their full legal name, address, and contact information. This information helps in identifying the buyer involved in the transaction.

05

Enter seller's information: Similarly, fill in the section dedicated to the seller's information, providing their full legal name, address, and contact details as well. This section ensures that the correct seller is identified in the agreement.

06

Describe the property: Specify the details of the property being purchased, including its address, legal description, and any other relevant information that accurately identifies the property.

07

State the purchase price: Clearly indicate the agreed-upon purchase price for the property, making sure the amount is accurate and consistent with the terms of the agreement.

08

Specify earnest money deposit: Enter the amount of earnest money that the buyer will deposit as part of this agreement. This amount typically reflects a percentage of the purchase price and is held in escrow until the completion of the sale.

09

Include contingency provisions if necessary: If there are any contingency provisions in the agreement, such as home inspection or financing contingencies, make sure to include them and clearly outline their terms.

10

Review and revise if needed: Before finalizing the agreement, carefully review all the provided information for accuracy. If necessary, make any revisions or additions to ensure the agreement accurately represents the terms agreed upon by both parties.

Who needs earnest money agreement sample:

01

Buyers: Buyers who are in the process of purchasing real estate can benefit from an earnest money agreement sample. It helps them understand the necessary components and terms that should be included in such an agreement.

02

Sellers: Sellers involved in real estate transactions can also find an earnest money agreement sample useful. It enables them to familiarize themselves with the content and structure of the agreement.

03

Real estate agents: Real estate agents who represent buyers or sellers can use an earnest money agreement sample as a reference tool to assist their clients in understanding the process and requirements involved in the earnest money agreement.

Fill

gold purchase agreement template

: Try Risk Free

People Also Ask about sample purchase contract

What is an earnest money agreement?

Earnest money, or good faith deposit, is a sum of money you put down to demonstrate your seriousness about buying a home. In most cases, earnest money acts as a deposit on the property you're looking to buy. You deliver the amount when signing the purchase agreement or the sales contract.

What is a legally binding contract between buyer and seller?

A purchase agreement is a legal document that is signed by both the buyer and the seller. Once it is signed by both parties, it is a legally binding contract. The seller can only accept the offer by signing the document, not by just providing the goods.

What is the earnest money form?

An earnest money agreement is a legal document that outlines the terms between two parties, typically for the purchase and sale of real estate. When buying a property, a buyer will provide an earnest money deposit to signal their intentions are high to move forward with the transaction.

How do I write an earnest money agreement?

[Buyer. FirstName][Buyer. LastName] at this moment agrees to pay a sum of $(Total Purchase Price of the Property) for the property as outlined above or a cash equivalent. The buyer agrees to settle or discharge all previous debts and obligations of any nature within the county in which the said property is located.

Is earnest money required to make a contract binding?

A real estate contract is valid whether there is an earnest money deposit or not. While a contract, to be valid, must have consideration, the earnest money is not consideration. Earnest money is a good faith deposit and is not necessary to have a valid contract.

What is consideration in a contract if it is not earnest money?

However, is a “deposit” necessary to create a binding real estate purchase/sell contract? The California definition of “consideration” using the language of “any benefit conferred, or agreed to be conferred” and “or any prejudice suffered, or agreed to be suffered.”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my purchase contract and escrow instructions in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your signing a contract with a realtor to buy and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I fill out earnest money contract template on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your example of purchase agreement, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Can I edit greater las vegas association of realtors on an Android device?

You can make any changes to PDF files, such as loan purchase agreement, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is form glvar residential?

Form GLVAR Residential is a document used by the Greater Las Vegas Association of Realtors to report information related to residential real estate transactions, including sales and listings.

Who is required to file form glvar residential?

Real estate agents and brokers involved in residential transactions in the Greater Las Vegas area are required to file form GLVAR Residential to ensure compliance with local regulations.

How to fill out form glvar residential?

To fill out form GLVAR Residential, a realtor must provide details such as property address, sale price, buyer and seller information, and any pertinent conditions or terms of the transaction.

What is the purpose of form glvar residential?

The purpose of form GLVAR Residential is to collect standardized data on residential real estate transactions, which helps in market analysis and maintaining transparency within the real estate market.

What information must be reported on form glvar residential?

Information that must be reported on form GLVAR Residential includes property details (address, type), transaction details (sale price, dates), and parties involved (buyer, seller) in the residential real estate deal.

Fill out your purchase contract example form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Glvar is not the form you're looking for?Search for another form here.

Keywords relevant to buyers agreement form

Related to earnest money escrow agreement

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.